Comprehensive Guide to Futures & Options Taxation: Turnover Calculation, ITR Filing, Audit Requirements, Section 44AD, and Loss Treatment

Introduction to F&O Taxation

Futures and Options (F&O) are versatile derivatives in the Indian stock market that allow traders to hedge risks, speculate on price movements, and leverage their positions for higher returns. These instruments derive their value from an underlying asset, such as stocks, indices, commodities, or currencies, and are widely used by both individual and institutional investors. While F&O trading offers significant opportunities, it also involves a degree of complexity, especially in taxation.

This guide aims to simplify the tax implications of F&O trading by covering:

- How F&O income is categorized under the Income Tax Act.

- The correct Income Tax Return (ITR) form to file.

- Detailed steps for calculating F&O turnover.

- Tax audit applicability criteria.

- Appropriate methods for handling losses arising from F&O transactions.

Speculative vs Non-Speculative Transactions in Income Tax

The Income Tax Act distinguishes between speculative transactions and non-speculative transactions (F&O):

| Aspect | Speculative Transactions | Non-Speculative Transactions (F&O) |

|---|---|---|

| Delivery | No actual delivery (e.g., intraday) | No actual delivery, cash-settled |

| Tax Classification | Speculative business income | Non-speculative business income |

| Loss Adjustment | Only against speculative income | Against all business income |

| Loss Carry Forward | Up to 4 years | Up to 8 years |

Which ITR to File for F&O Trading?

The appropriate ITR form depends on your income type and turnover:

1. ITR-3

Who Should File

- Individuals and HUFs earn income from proprietary business or profession.

- Includes non-speculative business activities, like F&O trading.

When to Use

- If you maintain regular books of accounts for F&O trading.

- If your income or turnover exceeds limits for presumptive taxation.

2. ITR-4 (Sugam)

Who Should File

- Individuals, HUFs, and firms (excluding LLPs) opting for presumptive taxation under Section 44AD, 44ADA, or 44AE.

When to Use

- If your turnover is below ₹3 crore and income is declared at 6% for non-cash transactions or 8% for cash transactions.

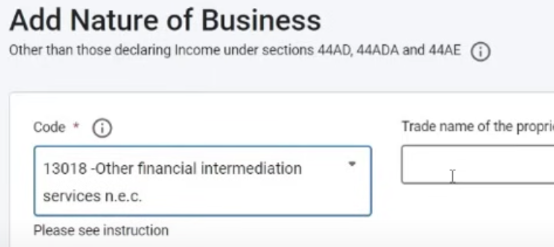

Business Code:

For F&O trading in ITR-3, use Business Code 13018:

Calculation of Turnover for F&O Transactions (As Per ICAI Guidance Notes)

The Institute of Chartered Accountants of India (ICAI) has updated its guidance on the calculation of turnover for Futures and Options (F&O) transactions in the 8th Edition of Guidance Notes (August 2022). These updates streamline the process, particularly for options traders. Here’s a detailed breakdown:

1. Futures Transactions

| Transaction | Profit/Loss | Absolute Value |

|---|---|---|

| Trade 1 | ₹60,000 | ₹60,000 |

| Trade 2 | -₹40,000 | ₹40,000 |

| Trade 3 | ₹30,000 | ₹30,000 |

Options Turnover:

₹25,000 + ₹15,000 + ₹20,000 = ₹60,000

Total Turnover: ₹1,30,000 (Futures) + ₹60,000 (Options) = ₹1,90,000

Profit, Expenses & Tax in F&O

1. Tax on F&O Profits

Taxed as business income under applicable slab rates (0%-30% for individuals or HUFs).

2. Claiming Expenses

Deduct eligible expenses like brokerage fees, audit fees, software subscriptions, and depreciation on assets used for trading.

3. Presumptive Taxation:

Under Section 44AD, no expenses can be claimed, and income is presumed at 6% or 8% of turnover.

Tax Audit Applicability for F&O

Turnover Up to ₹3 Crore

No audit if presumptive taxation is opted for under Section 44AD.

Turnover Between ₹3 Crore and ₹10 Crore

No audit if cash transactions ≤ 5% of total receipts and payments.

Turnover Exceeding ₹10 Crore

Tax audit mandatory

| Turnover | Cash Transactions ≤ 5% | Tax Audit Required |

|---|---|---|

| Up to ₹3 crore | Yes | No |

| ₹3 crore to ₹10 crore | Yes | No (if books maintained) |

| ₹3 crore to ₹10 crore | No | Yes |

| Above ₹10 crore | Irrespective | Yes |

Advance Tax Liability

Advance tax is applicable if the total liability exceeds ₹10,000 in a financial year.

| Due Date | Percentage of Tax Payable | Cumulative Tax Payable |

|---|---|---|

| June 15th | 15% | 15% |

| September 15th | 45% | 60% |

| December 15th | 75% | 75% |

| March 15th | 100% | 100% |

Key Points to Note

Applicability for Presumptive Taxation:

If you opt for the Presumptive Taxation Scheme (Section 44AD), you are only required to pay 100% of the advance tax by March 15th of the financial year.

Calculation of Tax Liability:

- Include income from F&O trading, salary, house property, capital gains, and any other sources to determine your total taxable income.

- Deduct eligible deductions under Section 80C to 80U and calculate the final tax liability to determine advance tax.

Case Study: How a Farmer's F&O Trading Led to a ₹68 Crore Tax Nightmare

What happens when you overlook the rules of reporting F&O trading in your tax filings? A Karnataka-based farmer learned this the hard way. His brief foray into Futures and Options (F&O) trading not only drained his finances but also put him in serious trouble with the Income Tax Department. Let’s dive into this eye-opening case and its key lessons for F&O traders.

The Story: From Trading to Trouble

The Beginning

⦁ The farmer traded in F&O during FY14, incurring a loss of ₹26 lakh.

⦁ Believing there was no need to report losses, he skipped declaring F&O transactions in his Income Tax Return (ITR).

The First Warning – IT Notices

⦁ In 2022, the Income Tax Department flagged his PAN for high-value transactions in F&O trading.

⦁ His total F&O turnover, including both sales and purchases, amounted to ₹69 crore—an amount that caught the department’s attention.

⦁ A reassessment case for FY14 was opened in 2021 to verify his undisclosed transactions.

The Turning Point – Ignoring Emails

⦁ The farmer failed to check emails or respond to IT notices.

⦁ With no response, the department passed an ex-parte order, treating the ₹69 crore turnover as taxable income instead of mere trading volume.

The Tax Shock

In May 2023, the IT Department issued a demand order of ₹68 crore, comprising:

⦁ Tax on ₹69 crore deemed income.

⦁ Interest from FY14 onwards.

⦁ Heavy penalties for non-compliance.

Frozen Assets

⦁ By December 2024, the IT Department froze the farmer’s bank account to recover the tax demand.

⦁ Unable to afford the 20% upfront deposit required for appealing, the farmer is now caught in a web of legal battles.

What F&O Traders Can Learn

This case highlights critical lessons for anyone trading in F&O:

1. Always Report F&O Transactions

- Whether you make a profit or incur a loss, F&O trading must be reported under business income in your ITR.

2. Understand Turnover Calculations

- Turnover in F&O includes the absolute sum of profits and losses.

- Ignoring this can result in massive discrepancies during reassessments.

3. Respond to Notices Promptly

- Never ignore emails or communications from the IT Department.

- Prompt responses can prevent escalation and help clarify your case.

4. Seek Professional Help

- Engaging a Chartered Accountant (CA) ensures proper tax planning and compliance with F&O trading rules.

- Prompt responses can prevent escalation and help clarify your case.